Converting 401k to roth ira calculator

Roll over to a Wells Fargo IRA in 3 easy steps. You may convert your Traditional IRA over several years to manage the tax consequences.

Roth Conversion Q A Fidelity

With a Roth 401k you can take advantage of the company match on your contributions if your employer offers onejust like a traditional 401k.

. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. Its important that these be direct rollovers and not 60-day indirect rollovers. When you convert to a Roth IRA you must pay income tax on the otherwise taxable amount of the transfer.

The Roth feature provides recommendations on when to execute Roth conversions for my DW and I 401k funds. An IRA or individual retirement account is a type of investment account that allows you to save for retirement. Copy and paste this code into your website.

That direct rollover would be a taxable Roth conversion. A Roth IRA conversion lets you move some or all of your retirement savings from a Traditional IRA Rollover IRA SEP-IRA SIMPLE IRA or 401k into a Roth IRAThere are no age limits to convert and as of January 1 2010 the IRS eliminated Roth IRA conversion income restrictions allowing you to start taking advantage of unique Roth IRA benefits even if your current income. An IRA or individual retirement account is a type of investment account that allows you to save for retirement.

One more considerationYour IRA401k money is subject to Required Minimum Distributions RMDs when you reach age 70-12. That means youre obliged to withdraw a fraction of your IRA401k accounts around 35 in the first year and increasing slightly each year thereafter and pay income taxes on that amount withdrawn. Money in a traditional 401k or IRA grows tax deferred meaning that you pay taxes on the money when you withdraw the funds and no taxes at all when you invest the money.

First place your contribution in a traditional IRAwhich has no income limits. Converting to a Roth IRA may ultimately help you save money on income taxes. The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be withdrawn tax-free.

Now heres how it works. There are many different types of IRAs each with its own. The tools and information on this webpage permit you to model scenarios of converting a traditional IRA to a Roth IRA based on information you specify about your age.

Call 1-800-465-3472 to open an account. 1 This should be a rate that youve determined best represents the rate that the converted amount will be taxed at. Add Gold Silver Precious Metals to your IRA.

If you are a single or joint filer your maximum contribution starts to reduce at 125000 and 198000 for tax year 2021 and 129000 and 204000 for tax year 2022 respectively. Converting a traditional 401k to a Roth IRA is similar to rolling over your 401k to a traditional IRA with one extra step. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account.

The main difference between a Roth account and a traditional retirement savings account is tax treatment. A Roth account is a type of 401k or IRA. American Bullion specializes in Gold IRA rollovers.

What You Should Know About Converting Costs. Next you contribute the 6000 maximum to the traditional IRA. You become disabled or have passed away.

Get the latest financial news headlines and analysis from CBS MoneyWatch. To maximize the benefits of conversion the money to pay those taxes should come from a source outside the Traditional IRA you are converting. There are many different types of IRAs each with its own.

The Roth IRA has been in existence for at least five years. This process helps you make maximum tax-deferred contributions. You are age 59½ or older.

You must note that when you convert to a Roth IRA you must pay income tax on the otherwise taxable amount of. A direct rollover means that your 401k funds will be transferred directly from your 401k to your traditional IRA and Roth IRA without you touching the funds in between. Talk to a financial advisor to.

You will have to pay taxes on the money you convert. You may gain tax benefits by converting funds from employer-sponsored retirement plans such as a 401k into a Roth IRA. Choose an IRA transfer funds from your 401k and manage your savings.

Rolling over your 401k into an IRA is another option. Based on the conversions it looks like I would eliminate any RMDs starting at age 72. And the Roth component of a Roth 401k gives you the benefit of tax-free.

If you are not sure what your rate is or should be please consult a tax professional. Though in reality there are a few key differences between the two that are important to understand. If you plan to convert your traditional IRA into a Roth IRA to take advantage of tax-free growth you can avoid immediate tax consequences by first rolling over any pre-tax contributions over to your 401k.

In addition to a Traditional 401k and Roth 401k some providers offer an after-tax 401k. Afterward you convert the traditional IRA to a Roth IRA and pay income taxes owed on the money. And if you roll over your 401k into a Roth IRA your withdrawals in retirement will be tax-free.

Thats because Roth retirement accounts are funded with after-tax dollars while traditional 401ks are funded with pre-tax dollars. Then move the money into a Roth IRA using a Roth conversion. You open a traditional IRA and a Roth IRA at the same time preferably with the same manager.

You can convert a Traditional IRA to a Roth IRA at any time. Reasons Not to Roll Your IRA Into Your 401k. Related Retirement Calculator Investment Calculator Annuity Payout Calculator.

A conversion can get you into a Roth IRAeven if your income is too high. With an IRA youll have more control over how your money is invested. Your eligibility to open a Roth IRA and how much you can contribute is determined by your Modified Adjusted Gross Income MAGI.

Youll want to consult a tax professional when converting a traditional IRA to a Roth option. At first glance you might think Roth and after-tax 401k are the same thing since both have contributions made with after-tax dollars. However the Roth conversions have a.

Please verify with your plan administrator that your distribution is eligible for a rolloverconversion. The Roth 401k was introduced in 2006 and combines the best features from the traditional 401k and the Roth IRA. So thats an overview.

The conversion would be part of a 2-step process often referred to as a backdoor strategy.

Roth Ira Calculators

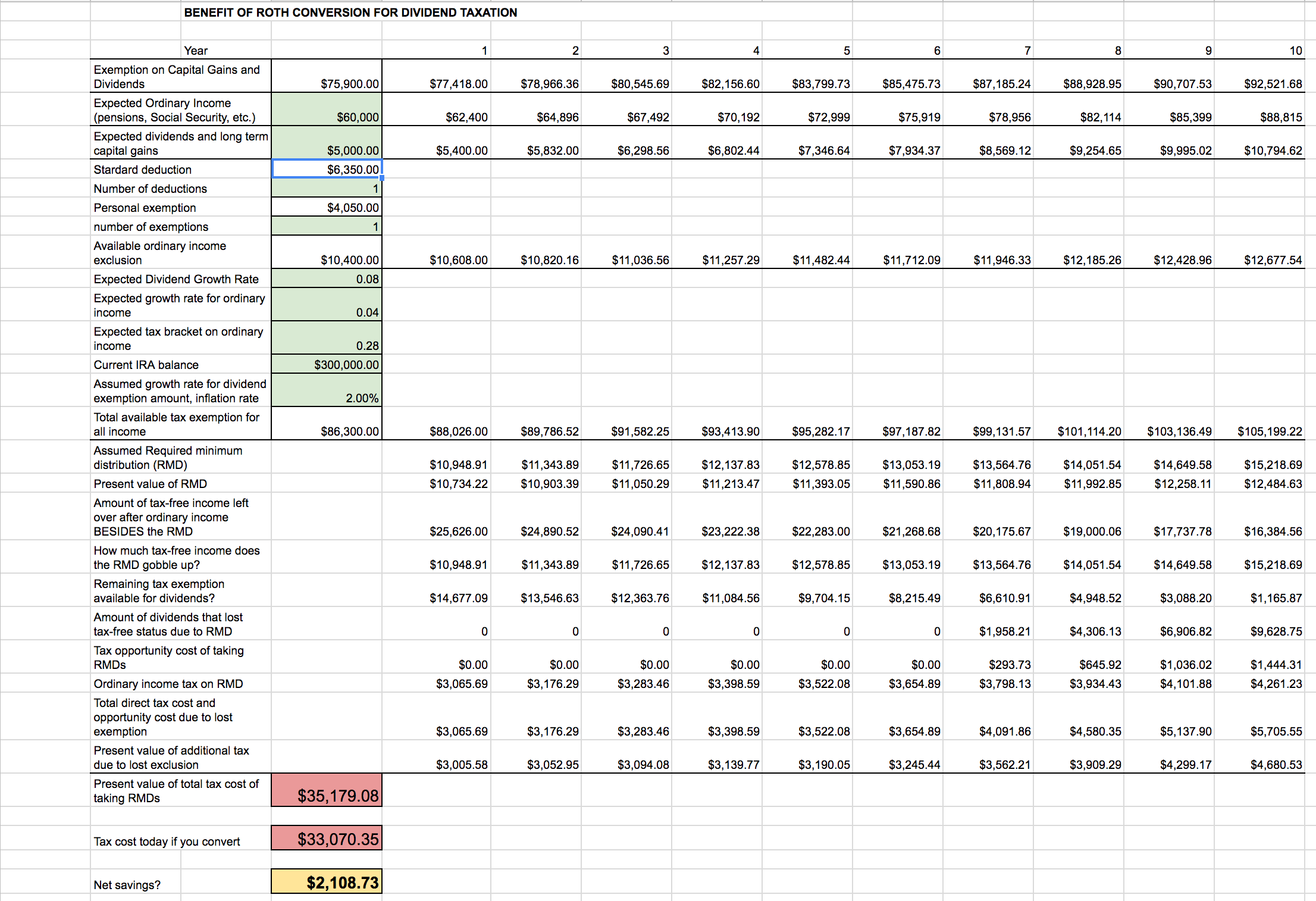

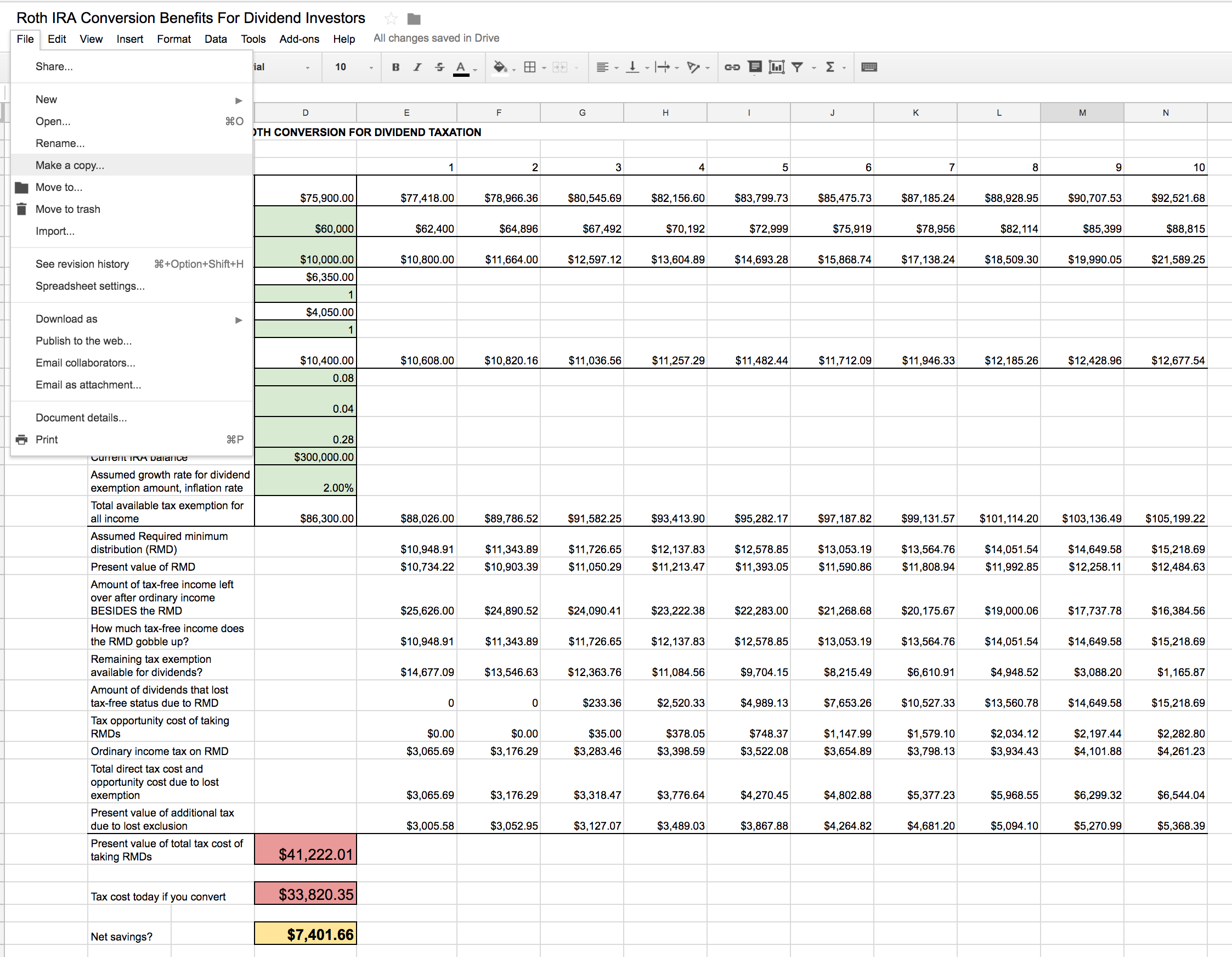

Roth Ira Conversion Spreadsheet Seeking Alpha

Diy Roth Conversion Engine Template Bogleheads Org

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Conversion Spreadsheet Seeking Alpha

Roth Ira Calculator Roth Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Traditional Vs Roth Ira Calculator

Systematic Partial Roth Conversions Recharacterizations

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Conversion Analysis Software And Optimal Strategy